While home prices are growing, home sizes are decreasing. More than a third of builders say they built smaller homes in 2023, and more than a quarter plan to construct even smaller this year, shares the NAHB. Home size is trending lower and will likely continue to do so as housing affordability remains constrained.

While home prices are growing, home sizes are decreasing. More than a third of builders say they built smaller homes in 2023, and more than a quarter plan to construct even smaller this year, shares the NAHB. Home size is trending lower and will likely continue to do so as housing affordability remains constrained.

Insights

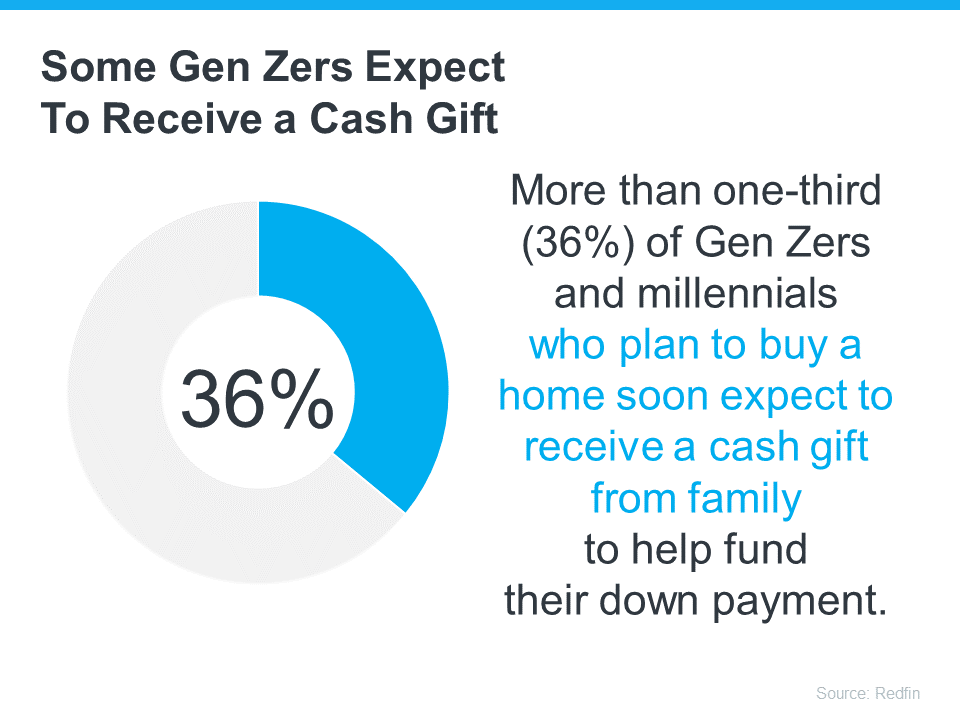

“The path to Gen Z homeownership may have its own share of challenges, but that’s not stopping Gen Z, nicknamed “Zoomers,” from buying homes. In fact, some Gen Z real estate trends are pointing in an optimistic direction. According to a recent study from a major real estate brokerage about 30% of 25-year-olds owned their own homes in 2022, 2-3% ahead of both millennials and Gen X at the same age.

Chase

“My personal forecast is that we will begin to see further progress on inflation this year. I don’t know that it will be sufficient; I don’t know that it won’t. I think we’re going to have to let the data lead us on that.

Jerome Powell, Chairman, Federal Reserve

Rates

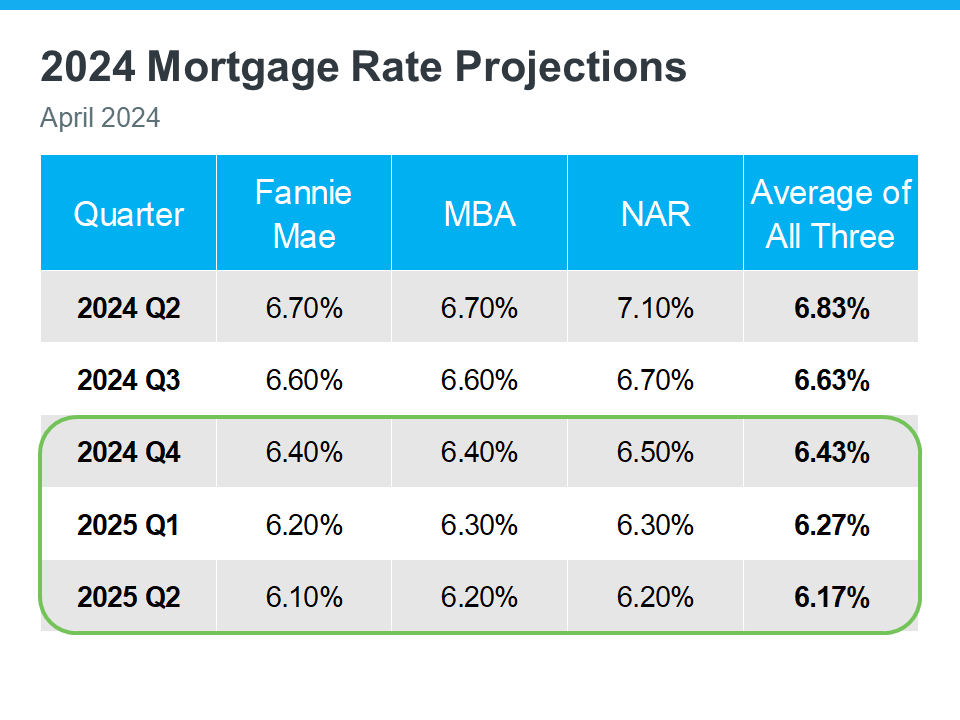

After benefitting from stable mortgage rates in the first couple of months of the year, the housing market witnessed a slowdown in March due to the rebound in rates. Expect rates to come down in the second half of 2024 but remain above 6% this year. Even a modest drop in rates will bring both more buyers and more sellers into the market.

After benefitting from stable mortgage rates in the first couple of months of the year, the housing market witnessed a slowdown in March due to the rebound in rates. Expect rates to come down in the second half of 2024 but remain above 6% this year. Even a modest drop in rates will bring both more buyers and more sellers into the market.

Inventory

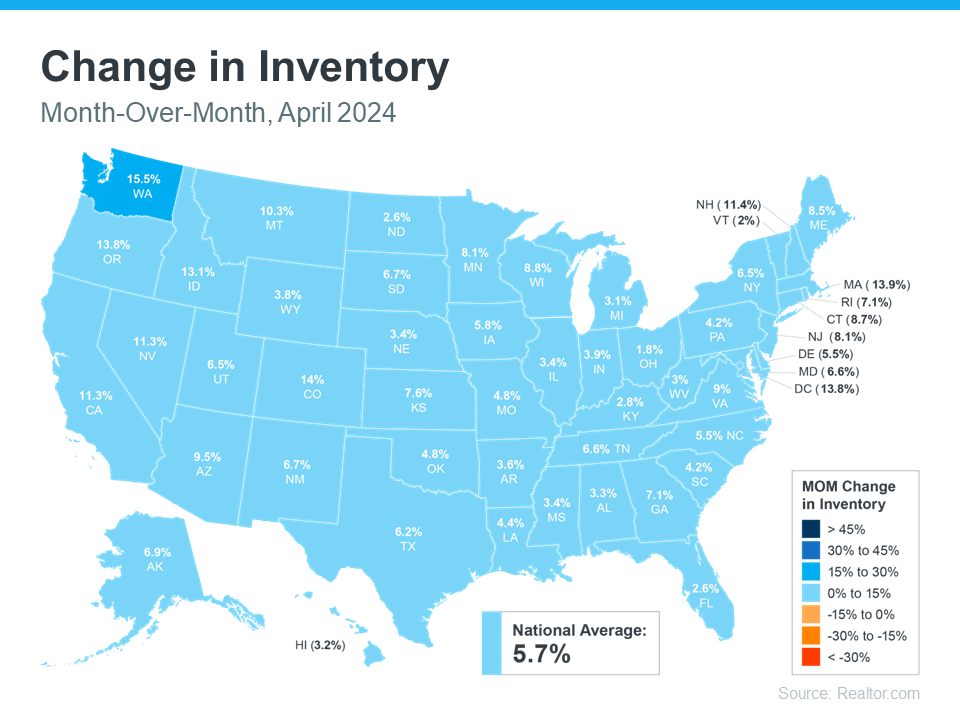

US Existing Home Inventory is at a current level of 1.11M, up from 1.06M last month and up from 970,000.0 one year ago. This is a change of 4.72% from last month and 14.43% from one year ago. – National Association of Realtors

US Existing Home Inventory is at a current level of 1.11M, up from 1.06M last month and up from 970,000.0 one year ago. This is a change of 4.72% from last month and 14.43% from one year ago. – National Association of Realtors

Prices

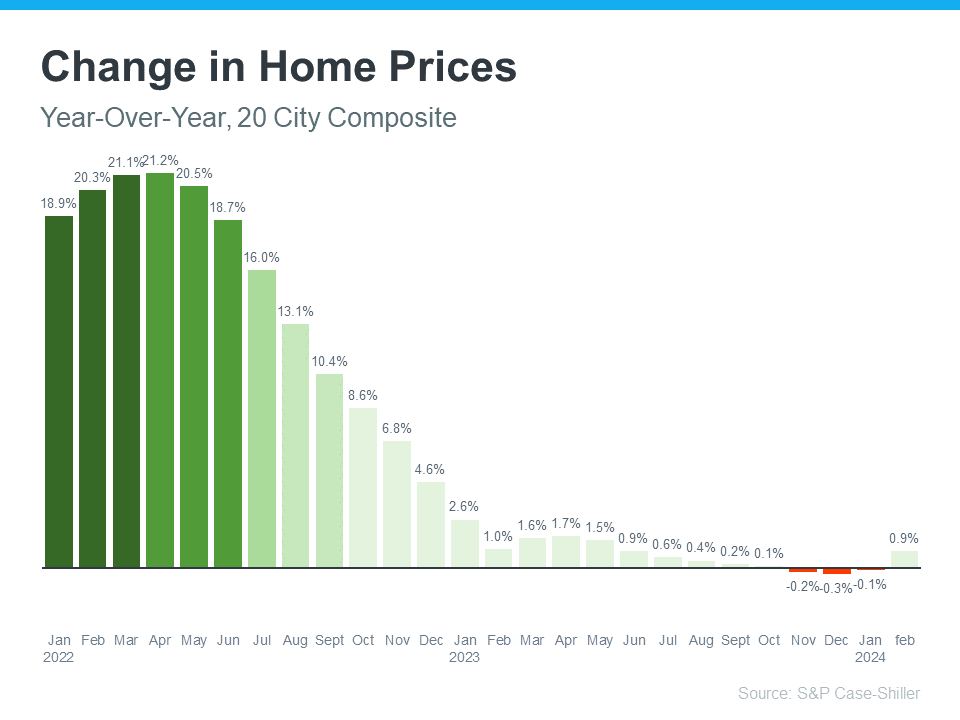

“Following last year’s decline, U.S. home prices are at or near all-time highs,” says Brian D. Luke, Head of Commodities, Real Digital Assets at S&P Dow Jones Indices. “Our National Composite rose by 6.4% in February, the fastest annual rate since November 2022. Our 10- and 20-City Composite indices are currently at all-time highs. For the third consecutive month, all cities reported increases in annual prices, with four currently at all-time highs: San Diego, Los Angeles, Washington, D.C., and New York. On a seasonal adjusted basis, our National, 10- and 20- City Composite indices continue to break through previous all-time highs set last year.”

“Following last year’s decline, U.S. home prices are at or near all-time highs,” says Brian D. Luke, Head of Commodities, Real Digital Assets at S&P Dow Jones Indices. “Our National Composite rose by 6.4% in February, the fastest annual rate since November 2022. Our 10- and 20-City Composite indices are currently at all-time highs. For the third consecutive month, all cities reported increases in annual prices, with four currently at all-time highs: San Diego, Los Angeles, Washington, D.C., and New York. On a seasonal adjusted basis, our National, 10- and 20- City Composite indices continue to break through previous all-time highs set last year.”

Sales

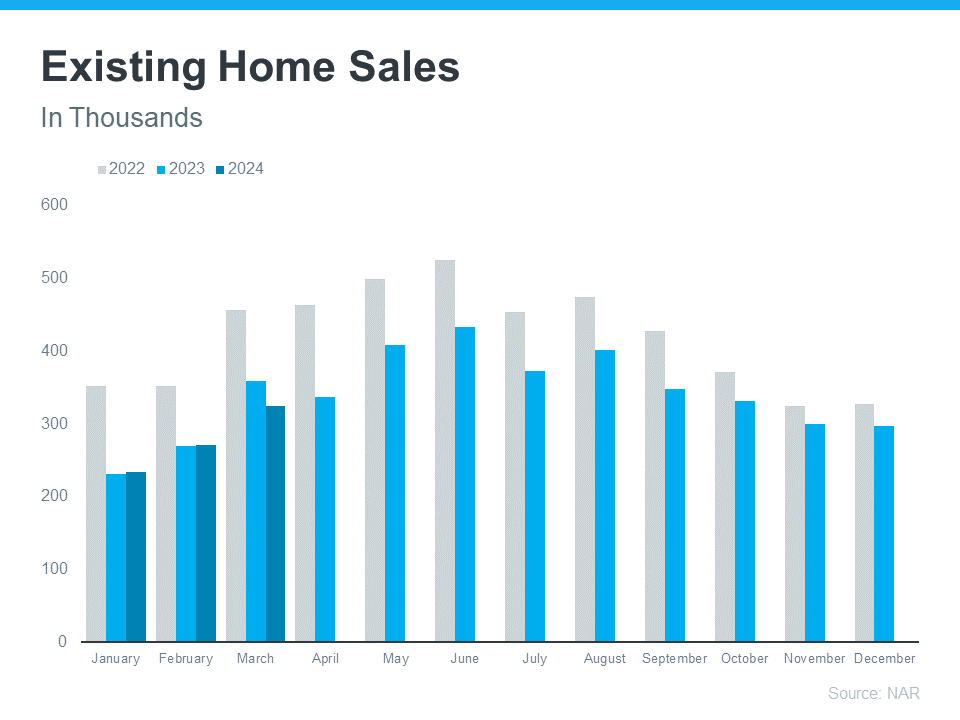

Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves. In March 2024, sales fell in the Midwest, South, and West, but rose in the Northeast for the first time since November 2023. Year-over-year, sales decreased in all regions.

Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves. In March 2024, sales fell in the Midwest, South, and West, but rose in the Northeast for the first time since November 2023. Year-over-year, sales decreased in all regions.

Wealth

The turbulent economy of the last few years has left more than a few people wondering, “Will Gen Z be able to afford houses?” The short answer (and good news) is probably yes — despite some potential trepidations surrounding homeownership, first-time homebuyers who were born between 1997 and 2012 may have cause for optimism. – Chase

The turbulent economy of the last few years has left more than a few people wondering, “Will Gen Z be able to afford houses?” The short answer (and good news) is probably yes — despite some potential trepidations surrounding homeownership, first-time homebuyers who were born between 1997 and 2012 may have cause for optimism. – Chase

Economics

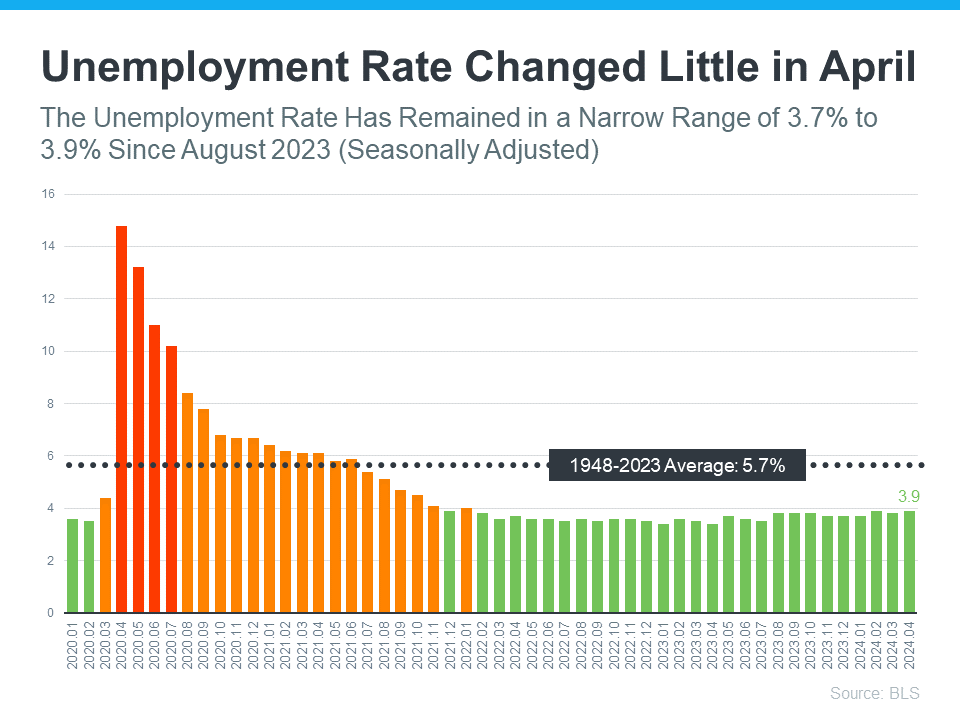

The U.S. economy added fewer jobs than expected in April while the unemployment rate rose, lifting hopes that the Federal Reserve will be able to cut interest rates in the coming months. Nonfarm payrolls increased by 175,000 on the month, below the 240,000 estimate from the Dow Jones consensus . . . The unemployment rate ticked higher to 3.9% against expectations it would hold steady at 3.8%. CNBC

The U.S. economy added fewer jobs than expected in April while the unemployment rate rose, lifting hopes that the Federal Reserve will be able to cut interest rates in the coming months. Nonfarm payrolls increased by 175,000 on the month, below the 240,000 estimate from the Dow Jones consensus . . . The unemployment rate ticked higher to 3.9% against expectations it would hold steady at 3.8%. CNBC

More Charts…

Do you love housing data? Whether you are a real estate expert or just learning about the market, this is the housing data to know. Enjoy 50+ charts illustrating the key metrics for the month.

Do you love housing data? Whether you are a real estate expert or just learning about the market, this is the housing data to know. Enjoy 50+ charts illustrating the key metrics for the month.